| VA Mortgage Loans

Helping Arizona Veterans Achieve Homeownership

VA mortgage loans provide Arizona’s service members, Veterans, and eligible surviving spouses with powerful home financing benefits. These government-backed loans—supported by the U.S. Department of Veterans Affairs—offer flexible guidelines, competitive rates, and affordable terms.

Team CD of Fairway Home Mortgage is proud to serve Arizona’s military community and support your path to homeownership throughout Phoenix, Tucson, Mesa, Chandler, Scottsdale, Glendale, Flagstaff, and beyond.

What Is a VA Loan?

A VA mortgage loan is a home loan guaranteed by the U.S. Department of Veterans Affairs. Because this guarantee reduces risk to lenders, Arizona Veterans and active-duty service members can purchase or refinance a home with no down payment required* in most cases.

This benefit honors your service and makes homeownership more accessible—especially in competitive markets across Arizona. VA loans also include flexible credit requirements, no PMI, and some of the most favorable terms available.

*A down payment may be required if full VA entitlement is not available or if the loan exceeds Arizona county loan limits. All VA loans are subject to VA entitlement, eligibility, qualifying factors (including credit and income), and property guidelines.

Why Arizona Buyers Choose VA Loans

VA home loans offer incredible advantages for Arizona borrowers, including:

Program Highlights

No private mortgage insurance (PMI) required

No down payment with full VA entitlement*

100% financing available

No prepayment penalties

Fixed-rate and adjustable-rate options

VA funding fee can be financed into the loan

Eligible for single-family homes, townhomes, and VA-approved condos across AZ

Frequently Asked Questions About VA Loans in Arizona

Will I Have to Pay Mortgage Insurance?

No. VA loans never require PMI, regardless of down payment amount.

Borrowers instead pay a VA funding fee, which can be paid upfront or rolled into the loan amount.

Some Arizona buyers—particularly those with service-connected disabilities—may be exempt from the funding fee.

Can I Roll My Closing Costs Into the Loan?

Some costs—like the VA funding fee—can be rolled into the total loan amount.

Most other closing costs must be paid upfront, but Our Team can help negotiate seller concessions to reduce your out-of-pocket expenses.

What Is a Certificate of Eligibility (COE)?

Your COE verifies your VA loan entitlement.

It reflects:

✅ Length and type of service

✅ Duty status

✅ Character of service

Team CD of Fairway can obtain your COE for you as part of your application, so you don’t have to track it down yourself.

Your COE will also show whether you have:

✅ Full entitlement (allows zero down)

✅ Partial entitlement (may require a down payment)

Can I Use a VA Loan More Than Once?

Yes—many Arizona buyers use VA loans multiple times.

If you still have an outstanding VA loan, you may have partial or no remaining entitlement. Paying off your previous VA loan or selling your property can fully restore entitlement.

Can I Use a VA Loan to Buy Land in Arizona?

Yes, if the land includes a home or will include a home with VA-approved construction.

The surrounding properties must also be residential in nature.

Example:

⚫️ A home on 5–10 acres in places like Prescott Valley or Queen Creek may qualify

⚫️ A purely agricultural or income-producing property generally will not

Are VA Construction Loans Available in Arizona?

VA construction loans are possible but not widely offered.

They require:

✅ A VA-approved Arizona builder

✅ VA-approved construction plans

✅ Additional documentation and underwriting

Call us today so we can walk you through the available options.

What Credit Score Do I Need in Arizona?

Fairway requires a minimum credit score of 580 to qualify for a VA loan.

Borrowers with scores from 580–599 may need additional documentation or underwriting review.

Call us to discuss your options.

VA LOAN OPTIONS

VA Adjustable-Rate Mortgage (ARM)

A strong option for Arizona service members who may relocate or receive PCS orders.

Lower introductory rate

Rate adjusts after the fixed period

Monthly payment may change based on market conditions

VA Fixed-Rate Mortgage

Best for long-term Arizona homeowners.

Predictable monthly payment

Choose a 30-year or 15-year term

Build equity faster with shorter terms

VA Cash-Out Refinance

Tap into your Arizona home’s equity to cover:

Home renovations (popular in older Phoenix/Tucson neighborhoods)

Education expenses

Debt consolidation

Major life expenses

You may also refinance a non-VA loan into a VA loan.

VA Interest Rate Reduction Refinance Loan (IRRRL)

A streamlined refinance option for existing VA borrowers.

Lower your interest rate

Reduce monthly payments

Minimal documentation

Convert an ARM to a fixed-rate

Cannot receive cash out

Every borrower’s situation is unique. Our team will walk you through the advantages of each loan option and tailor a strategy that fits your goals.

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

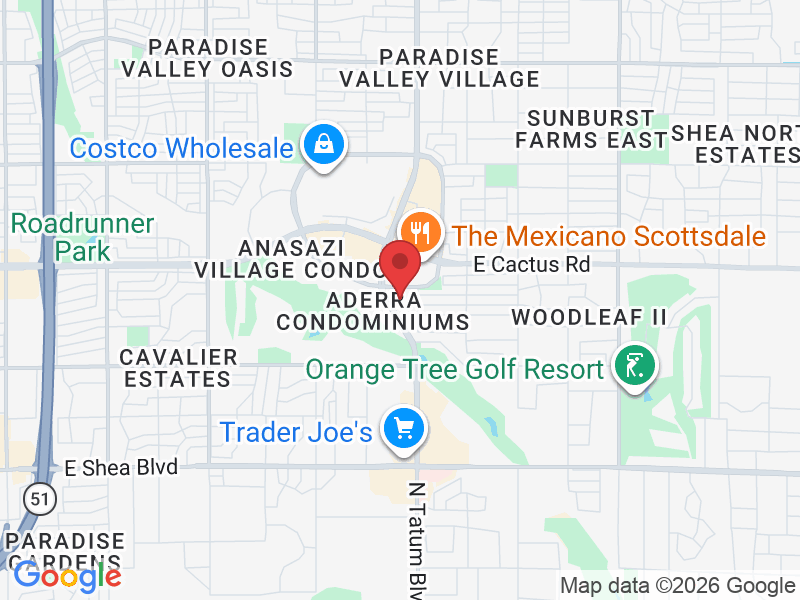

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202