| Mortgage Loan Options

Types of Home Loan Programs

From buying your dream home to accessing home equity, we have the mortgage loans to achieve your goals.

CONVENTIONAL

I have a strong credit score and steady income, and I want a competitive loan option.

Lower interest rates with good credit

Reduced or cancelable mortgage insurance

Flexible loan terms and options

FHA

I want easier credit requirements and more flexible qualification guidelines.

Lower credit score requirements

Smaller down payment options

Flexible income and debt guidelines

VA

I am a Veteran or Active Duty service member and want to use my VA benefits.

No down payment required

No monthly mortgage insurance

Competitive interest rates

DSCR

Debt Service Coverage Ratio

I want to qualify using rental income instead of personal income

Qualify using rental income

No personal income verification

Ideal for real estate investors

JUMBO

I need a larger loan amount than standard county limits allow.

Higher loan limits for luxury homes

Competitive rates for well-qualified buyers

Flexible property options

USDA

I want to live in a rural or suburban area and need affordable financing.

No down payment required

Low monthly mortgage insurance

Competitive interest rates

REVERSE

I am 62 or older and want to use my home equity for retirement cash flow.

No monthly mortgage payments required

(must pay critical property charges like taxes and insurance)Possibly access home equity as tax-free cash

Stay in your home while maintaining ownership

REFINANCE

I want to improve my current mortgage to better fit my financial goals.

Lower payments or better terms

Access home equity if needed

Simplify or restructure debt

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

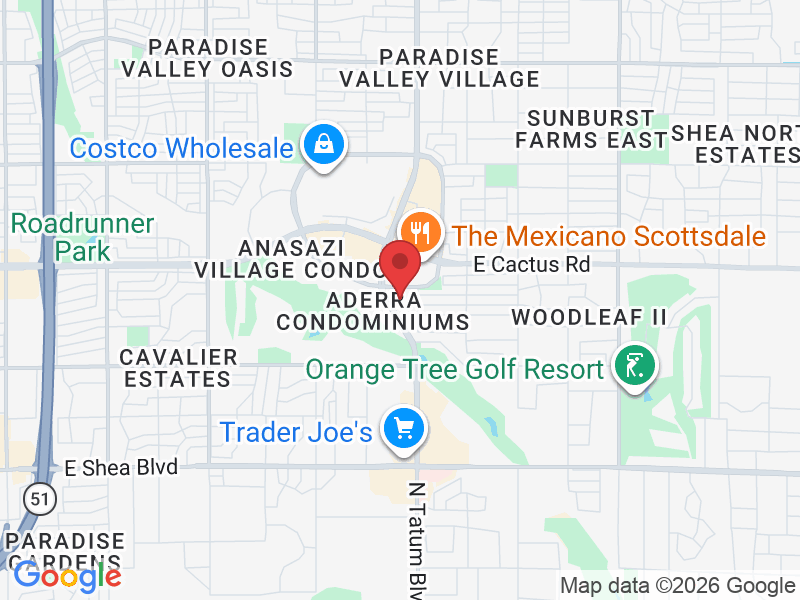

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202