| FHA Mortgage Loans in Arizona

FHA Mortgage Options — Opening the Doors to Homeownership

Team CD of Fairway Home Mortgage proudly offers FHA loans insured by the Federal Housing Administration (FHA). They’re designed to help first-time buyers and homebuyers with low-to-moderate incomes or limited credit history qualify for purchase or refinance financing when conventional loans may be difficult to obtain. An FHA mortgage can provide flexible qualifying guidelines, lower down payment requirements, and both fixed- and adjustable-rate options.

What Is aN FHA MORTGAGE Loan?

An FHA mortgage is a government-insured home loan backed by the U.S. Department of Housing and Urban Development (HUD). FHA insurance reduces risk for lenders and makes it easier for more borrowers to access mortgage credit — especially first-time buyers, people with smaller down payments, and those rebuilding credit.

Arizona FHA Loan Highlights

Low down payment options — typically as low as 3.5% for qualified borrowers.

Flexible credit guidelines — more forgiving than many conventional loan programs.

Available as fixed- or adjustable-rate terms.

Eligible for 1–4 unit properties and many condos (subject to approval).

Allow gift funds for down payment and seller contributions toward closing costs (seller contribution limit typically up to 6%). Subject to underwriting and FHA rules.

Arizona specifics — FHA loan limits (2026 examples)

FHA maximum loan amounts vary by county. Below are representative 2026 FHA limits for single-family (1-unit) homes in the largest Arizona counties — always confirm the county limit for the exact property location when running scenarios:

Maricopa County: $557,750 (1-unit).

Pima County: $541,287 (1-unit).

Coconino County (Flagstaff): $609,500 (1-unit).

Note: FHA limits change annually and differ by county and property type (1-4 units).

Contact us to confirm the exact limit for any address.

FHA 203(k) — Renovation financing with your mortgage

An FHA 203(k) loan lets buyers and homeowners roll qualified renovation costs into the mortgage — ideal for homes that need updates. Team CD can originate both Limited 203(k) (smaller, non-structural projects; typically up to $75,000) and Standard 203(k) (for larger or structural renovations) depending on project scope and borrower eligibility. Talk with Team CD about which 203(k) option fits your project.

Loan types & refinances available with FHA

Fixed-rate FHA mortgages — stability and predictable monthly principal & interest.

Adjustable-rate (ARM) FHA mortgages — lower introductory rates for borrowers planning a shorter ownership horizon.

FHA Streamline Refinance — a simplified refinance for existing FHA borrowers (must meet current FHA streamline rules, including demonstrating net tangible benefit).

Frequently Asked Questions About FHA Loans in Arizona

Can you have a second mortgage with an FHA loan?

Generally FHA will not insure more than one mortgage for a borrower, but exceptions exist (e.g., relocation, vacating a jointly-owned property) and are handled case-by-case.

How can I get rid of FHA mortgage insurance?

If you put down greater than or equal to 10%, FHA mortgage insurance may fall off after ~11 years; with less than 10% down, borrowers typically remove FHA mortgage insurance by refinancing to a Conventional or VA loan if they qualify.

Are FHA mortgage rates lower than conventional rates?

It depends on credit profile and debt levels. Borrowers with strong credit sometimes find Conventional loans more advantageous, while borrowers with lower credit or higher DTI may find FHA more affordable overall. We can run a side-by-side comparison for your scenario.

For current rates, and a side-by-side scenario, contact us at (602) 858-6293

Ready to Explore Arizona FHA Home Loans?

Team CD of Fairway Home Mortgage specializes in personalized guidance through FHA purchases, FHA 203(k) rehab loans, and FHA refinances — with local Arizona experience and full service from application through closing. Contact Team CD directly to get pre-qualified and to discuss loan options for your Arizona address.

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

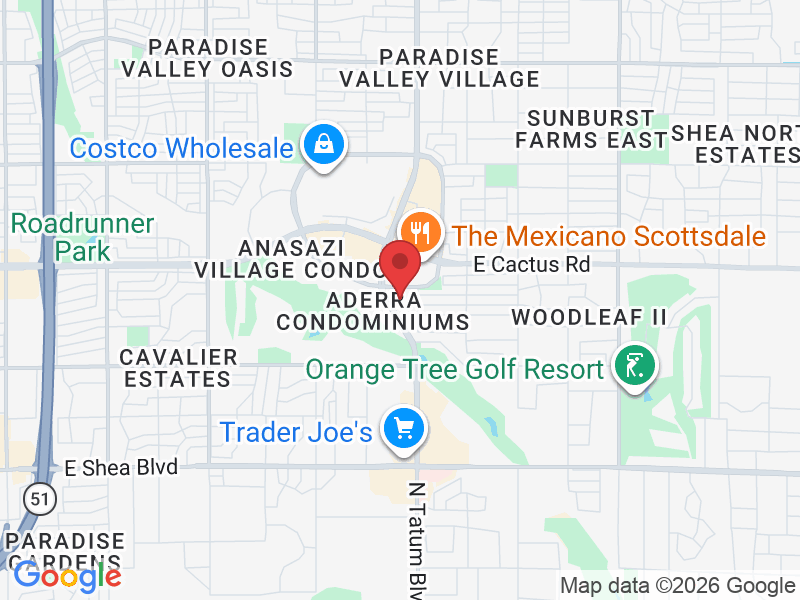

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202