| USDA Mortgage Loans in Arizona

Live Comfortably in Arizona’s Rural and Suburban Communities

Team CD of Fairway Home Mortgage proudly offers USDA mortgage financing to help Arizona families purchase homes in eligible rural, suburban, and expanding exurban areas. This government-backed program supports low- to moderate-income households with no down payment required, making homeownership more accessible throughout Arizona.

What Is a USDA Loan?

A USDA Rural Development Loan is designed to encourage homeownership in Arizona’s smaller towns and rural regions—from Chino Valley, Prescott Valley, and Payson to Sahuarita, Casa Grande, and surrounding Phoenix exurbs.

These loans are 30-year, fixed-rate mortgages backed by the U.S. Department of Agriculture, allowing Team CD of Fairway to offer competitive rates, flexible credit guidelines, and 100% financing options.

Arizona USDA Loan Highlights

Borrowers across Arizona benefit from:

100% financing (no down payment for qualified buyers)

Ability to roll the upfront guarantee fee into the loan

Lower interest rates than many Conventional loans

Flexible credit score requirements

Lower closing costs compared to other loan programs

Gift funds allowed for closing costs

Always a 30-year fixed-rate mortgage

Eligible in many Arizona rural & suburban areas

(including areas outside Phoenix, Tucson, Flagstaff & Prescott metro boundaries)

Frequently Asked Questions About USDA Loans in Arizona

What Arizona homes qualify for a USDA loan?

To qualify, a property must:

⚫️ Be located in a USDA-eligible Arizona area (many outskirts of Phoenix, Tucson, and Flagstaff qualify)

⚫️ Be used as your primary residence

⚫️ Meet USDA property condition guidelines

Eligibility can vary widely—from Maricopa outskirts to Pinal, Yavapai, Cochise, Mohave, Gila, Navajo, and Apache counties. Team CD can verify any address for you.

Who is eligible in Arizona?

Borrowers must:

⚫️ Have household income ≤115% of the local Arizona median income

⚫️ Be a U.S. citizen, non-citizen national, or qualified alien

⚫️ Show the ability to pay the mortgage, taxes, insurance + USDA’s annual guarantee fee

Income limits vary by each Arizona county and household size.

What are current USDA interest rates in Arizona?

Rates fluctuate daily based on market conditions and your credit profile.

USDA loans often have lower rates than Conventional loans, giving Arizona buyers a more affordable monthly payment.

For current rates, contact us at (602) 858-6293

Does a USDA loan require mortgage insurance?

Not traditional mortgage insurance—USDA uses a guarantee fee:

⚫️ A small upfront fee (can be financed)

⚫️ A monthly fee included in your mortgage payment

For many Arizona buyers, USDA’s monthly costs are lower than Conventional PMI.

Can I refinance my USDA loan in Arizona?

Yes. USDA loans can be refinanced into:

✅ A lower rate

✅ A lower monthly payment

✅ Another USDA loan via USDA Streamlined Refinance (no appraisal or income docs required for eligible borrowers)

Ready to Explore Arizona USDA Home Loans?

Team CD of Fairway Home Mortgage is here to help Arizona homebuyers understand eligibility, verify USDA-approved areas, and guide you through the approval process.

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

Contact Info

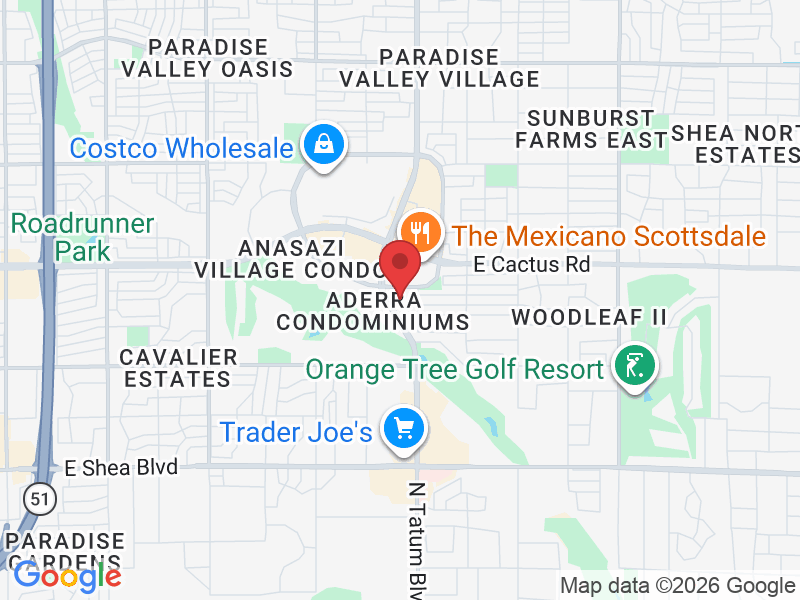

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202