| Arizona Refinance Loans

Smart Ways to Lower Your Payment, Reduce Your Term, or Access Equity

Team CD at Fairway Home Mortgage is here to help Arizona homeowners make the most of their home equity. Whether you’re looking to lower your rate, eliminate mortgage insurance, consolidate debt, or pull cash out for upgrades, we’ll guide you through every refinance option available.

Why Arizona Homeowners Refinance

Refinancing can be one of the most powerful financial tools available.

Here are the most common reasons homeowners across Phoenix, Tucson, Scottsdale, Mesa, Chandler, and beyond choose to refinance:

✔ Lower Your Monthly Payment

Reduce your interest rate or extend your loan term for budget-friendly monthly payments.

✔ Shorten Your Loan Term

Move from a 30-year to a 20- or 15-year loan and save tens of thousands in long-term interest.

✔ Consolidate High-Interest Debt

Roll credit cards, personal loans, or auto loans into one low, fixed mortgage payment.

✔ Access Home Equity (Cash-Out Refi)

Use your built-up equity to remodel, invest, pay medical bills, or fund education expenses.

✔ Remove Mortgage Insurance (PMI)

If your home value has increased—common in many Arizona markets—you may qualify to drop mortgage insurance.

✔ Switch from FHA to Conventional

Many Arizona homeowners refinance out of FHA loans to remove MIP and secure a better long-term payment.

Refinance Loan Options We Offer

Conventional Refinance

Ideal for borrowers with good credit and strong equity. Great for removing PMI.

FHA Refinance & FHA Streamline

Flexible options; Streamline refis require no appraisal and minimal documentation.

VA Interest Rate Reduction Refinance Loan (IRRRL)

For eligible veterans and active-duty service members. Fast and simple way to lower your rate.

USDA Streamlined Assist Refinance

Designed for rural AZ homeowners, with reduced documentation requirements.

Cash-Out Refinance

Tap into your home’s equity to access cash for any purpose.

REFINANCE CALCULATOR

Current Loan

New Refinance Loan

The Refinance Process with Team CD

We make refinancing smooth, transparent, and personalized:

1. Quick Loan Review

We’ll analyze your current mortgage, credit, and AZ market conditions.

2. Custom Strategy

We tailor refinance options based on your goals—lower payment, cash-out, or faster payoff.

3. Appraisal & Underwriting (when required)

Our team coordinates everything to keep the process easy on you.

4. Closing & Savings

Once your refinance is completed, you start benefiting from your new loan terms immediately.

FHA 203(k) — Renovation financing with your mortgage

An FHA 203(k) loan lets buyers and homeowners roll qualified renovation costs into the mortgage — ideal for homes that need updates. Team CD can originate both Limited 203(k) (smaller, non-structural projects; typically up to $75,000) and Standard 203(k) (for larger or structural renovations) depending on project scope and borrower eligibility. Talk with Team CD about which 203(k) option fits your project.

Why Arizona Homeowners Choose US

🌵 Local Arizona Expertise

We understand Arizona home values, equity trends, and neighborhood-level lending nuances.

🤝 Real Guidance, Real Support

You get personal, high-touch service—not an online-only experience.

⚡ Fast, Efficient Process

Fairway’s streamlined systems keep your refinance moving quickly.

🔒 Trusted, Transparent Lending

You’ll always know where you stand and what to expect.

Frequently Asked Questions About REFINANCE LOANS IN Arizona

How do I know if refinancing is worth it?

If you can lower your rate, drop mortgage insurance, shorten your term, or access equity at a low cost, refinancing can be a smart move. We run a full cost-benefit analysis for you.

Does refinancing require an appraisal?

Some programs do—others (like FHA Streamline and VA IRRRL) may not. We’ll advise what’s required.

Can I refinance if my credit isn't perfect?

Yes. FHA and some other loan programs allow flexible credit options.

How much equity do I need for a cash-out refinance?

Most borrowers need at least 20% equity in their home. Arizona’s rising home values often help meet that threshold.

Can I remove PMI or MIP with a refinance?

Absolutely. If you refinance into a conventional loan and have at least 20% equity, mortgage insurance can often be removed. Many Arizona homeowners switch from FHA to conventional specifically to eliminate MIP.

Can I switch from FHA to conventional?

Yes. Many borrowers refinance from FHA to conventional to remove the monthly mortgage insurance and secure better long-term payments. We’ll check credit, equity, and current Arizona market conditions to determine eligibility.

How long does the refinance process take?

Most refinances take 20–30 days in Arizona. Streamlined programs like the FHA Streamline or VA IRRRL may close even faster with minimal documentation.

Ready to Explore Your Refinance Options?

Team CD is here to help every step of the way.

We are just a call away for:

👉 A FREE Refinance Review

👉 To See How Much You Can Save

👉 For Cash-Out Refinance Options

TEAM CD MORTGAGE BLOG

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

Contact Info

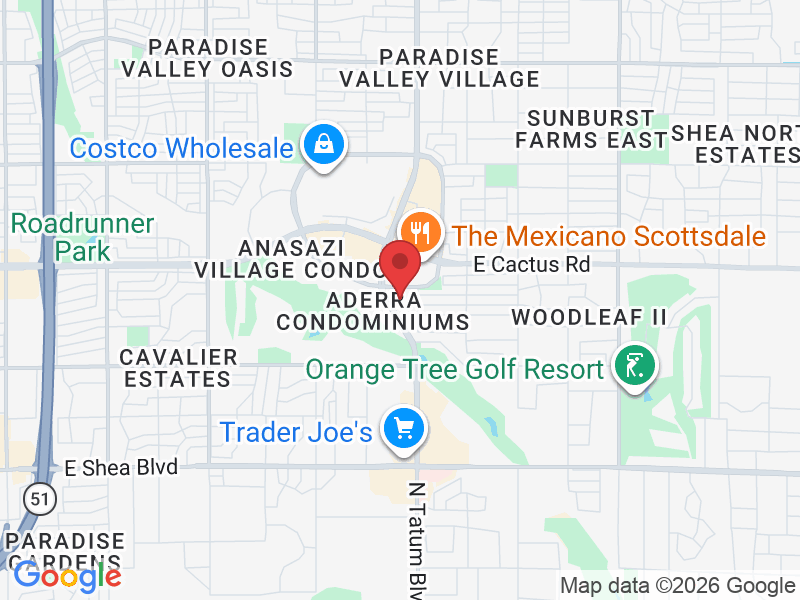

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202