| Reverse Mortgage Loans in Arizona

Unlock the Equity in Your Arizona Home — With No Monthly Mortgage Payment Required*

For Arizona homeowners 62 and older, a reverse mortgage—most commonly the HECM (Home Equity Conversion Mortgage)—offers a safe, FHA-insured way to convert home equity into tax-free cash* while eliminating monthly mortgage payments.

Whether you live in Phoenix, Tucson, Mesa, Scottsdale, Chandler, Flagstaff, Sedona, Prescott, or anywhere else in Arizona, Team CD of Fairway Home Mortgage provides trusted guidance, clarity, and integrity every step of the way.

*You remain the owner of your home. You continue paying property taxes, insurance, and home maintenance.

What Is a REVERSE MORTGAGE Loan?

A reverse mortgage allows qualifying senior homeowners to access the equity in their homes without selling, moving, or making monthly mortgage payments.

The most common program, the HECM (Home Equity Conversion Mortgage), is backed by HUD and insured by the FHA—providing strong protections for Arizona seniors.

You can choose to receive your funds as:

A lump sum

A growing line of credit

Monthly payments

Or a combination

Benefits of a Reverse Mortgage IN Arizona

Key Advantages

No monthly mortgage payments (borrowers must still pay taxes, insurance, and maintenance)

Growing line of credit (unused funds grow over time)

Increase your retirement cash flow

Retain full ownership of your Arizona home

No repayment until the last borrower leaves the home

Bridge Medicare or health-care cost gaps

Increase your purchasing power for retirement living

Reverse Mortgage Eligibility Requirements

To qualify in Arizona, you must:

Be 62 years or older

Own your home outright or have significant equity

Live in the home as your primary residence (6+ months per year)

Property must be:

Single-family home

2–4 unit home

FHA-approved condo

Meet FHA’s minimal credit and property standards

Complete HUD-approved reverse mortgage counseling

Not be delinquent on any federal debt

Our Reverse Mortgage Loan Options

1. Home Equity Conversion Mortgage (HECM)

The FHA-insured reverse mortgage program used by most Arizona seniors. Only available through approved lenders—such as Team CD of Fairway Home Mortgage.

Ideal For: Seniors wanting security, flexibility, and federal protections.

2. Jumbo Reverse Mortgage

Perfect for high-value Arizona homes—common in Scottsdale, Paradise Valley, Sedona, and parts of Phoenix.

Allows access to substantially more equity than the FHA HECM loan limit of $1,249,125.

3. HECM for Purchase

Use a reverse mortgage to buy a new home—ideal for Arizona retirees wanting to:

Downsize

Move closer to family

Settle into a low-maintenance community

Relocate to Sedona, Tucson, Scottsdale, Prescott, or Flagstaff

Frequently Asked Questions About REVERSE MORTGAGES in Arizona

Does the reverse mortgage lender own your home?

No. You remain the owner. Title and deed stay in your name.

How is the required down payment determined (HECM for Purchase)?

Your required down payment depends on:

- Your age

- Current interest rates

- The lesser of purchase price or appraised value

Ready to Explore Your Arizona Reverse Mortgage Options?

Team CD of Fairway Home Mortgage specializes in personalized guidance through the Reverse Mortgage process.

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

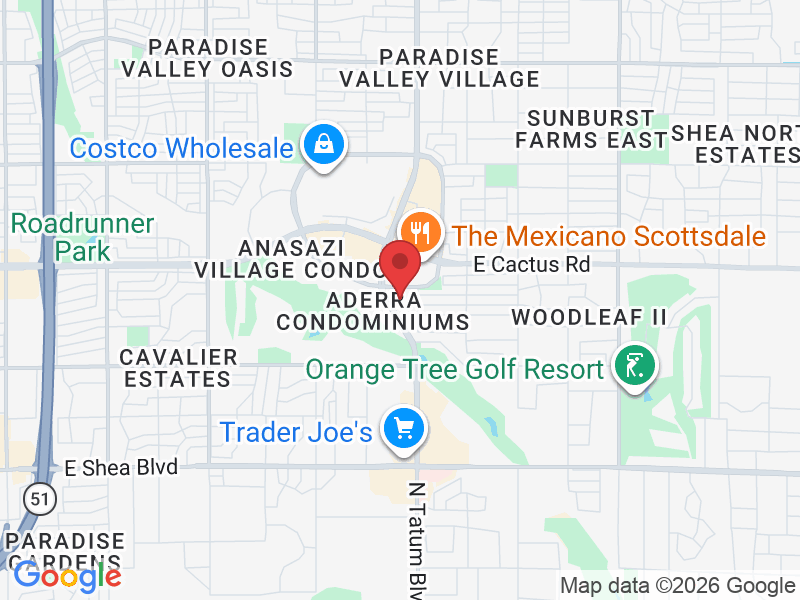

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202