| Conventional Loans in Arizona

Conventional Loan Options — Lower Rates With More Flexibility

A Conventional loan is any mortgage not insured or guaranteed by the federal government (as opposed to FHA, VA, or USDA Loans). Conventional Loans often have slightly higher down-payment requirements but offer greater flexibility, fewer restrictions, and competitive rates—making them a popular option for Arizona homebuyers seeking affordability and long-term savings.

What Is a Conventional Loan?

If you have solid credit, stable income, and a bit saved for a down payment, a conventional mortgage may be the ideal fit. Many Arizona borrowers prefer conventional loans because they typically offer:

Lower interest rates for borrowers with good or excellent credit

Flexible mortgage insurance options (and sometimes, no mortgage insurance at all)

Limited fees and fewer restrictions compared to government loans

Flexible loan terms (fixed or adjustable)

Down payments as low as 3%–20%+ depending on the program

Whether you’re buying in Phoenix, Scottsdale, Tucson, Mesa, Chandler, or anywhere across Arizona, Team CD at Fairway can help you determine if a conventional loan is the best match for your goals.

Conventional Loan FAQs

Can I get a conventional mortgage with 5% down in Arizona?

Yes! Some conventional loan programs allow for as little as 3% down, depending on eligibility.

The idea that you must put 20% down is one of the biggest myths in the home-buying process. However, when your down payment is below 20%, you'll typically pay private mortgage insurance (PMI) until you reach 20% equity.

Is a conventional loan the “best” type of mortgage?

There’s no universal “best” loan type. The right choice depends on your goals and financial profile.

A conventional mortgage may be ideal if you have:

- Good or great credit

- Stable employment and income

- Moderate savings for a down payment

However:

- If you are an active-duty service member, veteran, or eligible surviving spouse, a VA loan may offer better benefits.

- If you’re purchasing in rural Arizona, a USDA loan might be advantageous.

- If your credit score is lower or your debt-to-income ratio is higher, an FHA loan may offer easier qualification.

Team CD at Fairway will review your full financial picture and guide you toward the most advantageous option.

How soon can I refinance an FHA loan into a Conventional loan?

Many Arizona homeowners refinance from FHA to Conventional when:

1. They want to eliminate mortgage insurance.

FHA mortgage insurance remains for the life of the loan unless you refinance into a Conventional loan and have at least 20% equity.

2. Their credit has improved significantly.

Better credit may unlock lower conventional rates, which can create long-term savings.

3. Market conditions change.

Even with better credit, it’s not always the right time to refinance. Rates, home equity, and your financial situation all play key roles.

Contact us and we can evaluate when refinancing would be most beneficial for you.

Can I finance my closing costs with a Conventional loan?

There are multiple ways Arizona buyers can reduce or completely cover closing costs:

Seller concessions:

Your agent may negotiate with the seller to pay some or all closing costs. Feasibility depends on current market conditions in your area.

Lender-paid credits (“buying up” your rate):

You may choose a slightly higher interest rate to receive credits that cover closing costs.

Gift funds:

Many programs allow family members, employers, or close friends to contribute funds for closing costs.

Arizona down payment assistance programs:

Options vary by county and statewide program availability. Your Fairway advisor can check which programs may fit your situation.

Can I get a conventional loan if I owe taxes?

Owing taxes does not automatically disqualify you from getting a conventional mortgage. However, if a tax lien has been placed on your income or assets, this can prevent approval for a conventional loan through Fannie Mae.

If you owe taxes but have a repayment plan and have made on-time payments, you may still be eligible. Your Team CD advisor will help you understand your options.

Conventional Loans vs. FHA Loans: Quick Highlights

Conventional Loan May Be Better If:

You have strong to excellent credit

You have a low debt-to-income ratio

You want mortgage insurance that can eventually be removed

You want the lowest long-term cost possible

FHA Loan May Be Better If:

You have limited or lower credit

You need easier qualification standards

You prefer lower upfront cash requirements

You are a first-time buyer still building credit

Every borrower’s situation is unique. Our team will walk you through the advantages of each loan type and tailor a strategy that fits your goals.

TEAM CD MORTGAGE BLOG

Reverse Mortgage Occupancy Rules: What Homeowners Really Need to Know

Reverse mortgage occupancy rules explained: travel limits, the 12-month rule, primary residence requirements, and how to stay compliant. ...more

Reverse Mortgage

February 24, 2026•3 min read

Looking Beyond HELOCs: The Case for HomeSafe Second

Learn how HomeSafe® Second can help homeowners 55+ access home equity without refinancing, monthly payments, or giving up a low mortgage rate. ...more

Reverse Mortgage

February 06, 2026•2 min read

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

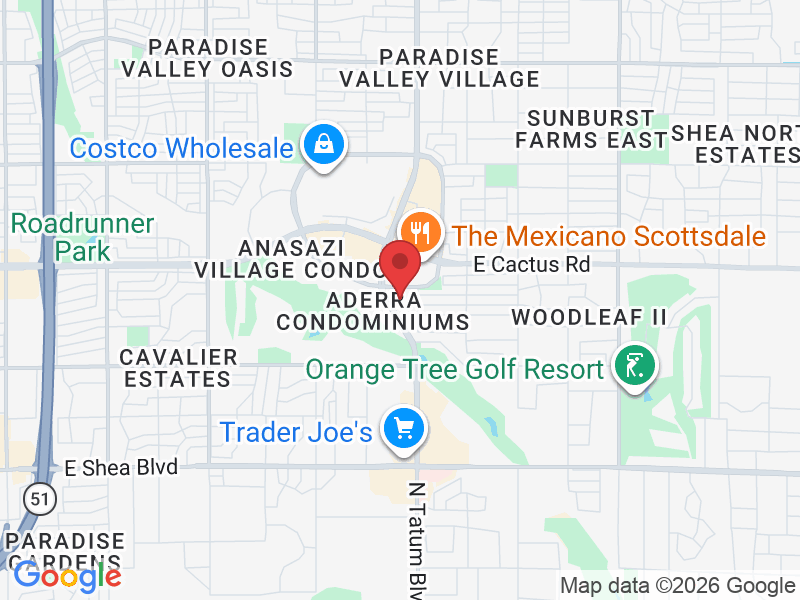

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202