| Jumbo Mortgage Loans in Arizona

Think BIG with a Jumbo Mortgage from Team CD at Fairway Home Mortgage

Arizona is home to luxury communities, custom homes, and high-value real estate—especially in areas like Scottsdale, Paradise Valley, Phoenix, Sedona, and Flagstaff. If you’re purchasing or refinancing a higher-priced property, a Jumbo Mortgage Loan may be the right solution.

Jumbo mortgage loans allow you to finance homes above the standard conforming loan limits set annually by the Federal Housing Finance Agency (FHFA). Team CD at Fairway Home Mortgage specializes in helping Arizona buyers and homeowners navigate jumbo financing with confidence, clarity, and personalized guidance.

What Is a JUMBO MORTGAGE Loan?

A jumbo mortgage is a home loan that exceeds the FHFA’s conforming loan limits. In many Arizona markets, home prices often surpass these limits—especially for luxury homes priced at $800,000, $900,000, or well over $1 million.

Because jumbo loans exceed government-backed limits, they are considered non-conforming loans and typically come with:

Higher credit score requirements

Larger down payment expectations

More detailed income and asset documentation

That said, jumbo loans also offer flexibility and powerful buying potential when structured correctly.

Conforming vs. Non-Conforming Loans Explained

Conforming loans meet the guidelines established by Fannie Mae and Freddie Mac, the government-sponsored entities (GSEs) that purchase mortgages from lenders and package them into mortgage-backed securities (MBS).

When a loan amount exceeds FHFA limits:

It becomes non-conforming

It is not bundled into MBS

It requires alternative underwriting standards

At Fairway Home Mortgage, Team CD works with a wide range of jumbo loan programs, ensuring Arizona buyers aren’t limited just because they’re buying a higher-value home.

Jumbo Loan Highlights

A jumbo mortgage may be ideal if you have strong financial qualifications but need a larger loan amount.

Key benefits include:

Higher purchase limits to buy more home in Arizona’s competitive markets

One convenient loan instead of multiple mortgages

Available for primary residences, second homes, and investment properties

Fixed-rate and adjustable-rate mortgage (ARM) options

Jumbo options available across Conventional, VA, and renovation loans

Things to keep in mind:

Jumbo mortgage rates are typically higher than conforming conventional loans

Larger down payments are often required, especially for second homes and rentals

Jumbo Mortgage Loan Options in Arizona

Team CD at Fairway Home Mortgage offers a variety of jumbo solutions, including:

Jumbo Fixed-Rate Mortgages

Jumbo Adjustable-Rate Mortgages (ARM)

Jumbo VA Loans (for eligible veterans)

Jumbo Renovation Loans

Jumbo Loans for Vacation & Investment Properties

JUMBO MORTGAGE FAQs

How much is the down payment on a jumbo loan?

Down payment requirements vary based on loan program, property type, and market conditions. At Fairway, some jumbo programs allow down payments as low as 10% for primary residences, compared to 3% on many conforming loans.

Guidelines can change, and Team CD may have access to multiple jumbo options—so it’s always best to review your specific scenario.

What is a super-jumbo mortgage?

A super-jumbo loan exceeds both the conforming and standard jumbo limits set by the FHFA. These loans are typically used for properties over $1,000,000, which are common in luxury Arizona markets.

Super-jumbo loans often require stronger financial profiles but provide unmatched buying power.

What is a jumbo reverse mortgage?

A jumbo reverse mortgage is designed for homeowners age 62 or older who own higher-value homes and want to convert equity into cash for retirement expenses. It works like a traditional reverse mortgage but applies to properties above conforming limits.

For current rates, and a side-by-side scenario, contact us at (602) 858-6293

Why Choose Team CD at Fairway Home Mortgage?

Deep experience with Arizona jumbo loan markets

Personalized loan strategies for high-net-worth borrowers

Access to multiple jumbo and super-jumbo programs

Trusted guidance from application to closing

Whether you’re buying a luxury home, second residence, or refinancing an existing jumbo loan, Team CD is here to help you think bigger—with confidence.

TEAM CD MORTGAGE BLOG

New HECM Limits for 2026

The 2026 HECM limits are here. Learn how the new $1,249,125 FHA limit may increase your options. ...more

Reverse Mortgage

January 15, 2026•3 min read

VA Loans in Arizona: A Quick Guide for Veterans, Active-Duty, and Military Families

VA Loans in Arizona offer zero down, flexible credit, and low rates. Learn eligibility, benefits, and how to buy or refinance a home. ...more

Mortgage Education ,Home Buyer Tips Homeownership & Equity &Veteran Loans - VA

January 12, 2026•2 min read

Conventional Loans in Arizona: Requirements, Benefits & Expert Tips for Homebuyers

Learn how conventional loans work in Arizona, including requirements, down payment options, mortgage insurance rules, and advantages over FHA loans. Discover whether a conventional loan is the right f... ...more

Loan Programs ,Conventional Loans &First Time Home Buyer

December 03, 2025•4 min read

HECM vs. HEI: Understanding the Safer Way to Tap Home Equity in Retirement

Unlocking home equity in retirement? Discover the key differences between a federally insured HECM reverse mortgage and a private HEI so you can protect your savings and long-term security. ...more

Mortgage Education ,Loan Programs &Reverse Mortgage

November 22, 2025•4 min read

Arizona First-Time Homebuyer Programs You Should Know About (2025 Guide)

Arizona home loan basics to help buyers understand options and qualify confidently. ...more

Arizona Market Insights ,Home Buyer Tips

November 22, 2025•3 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

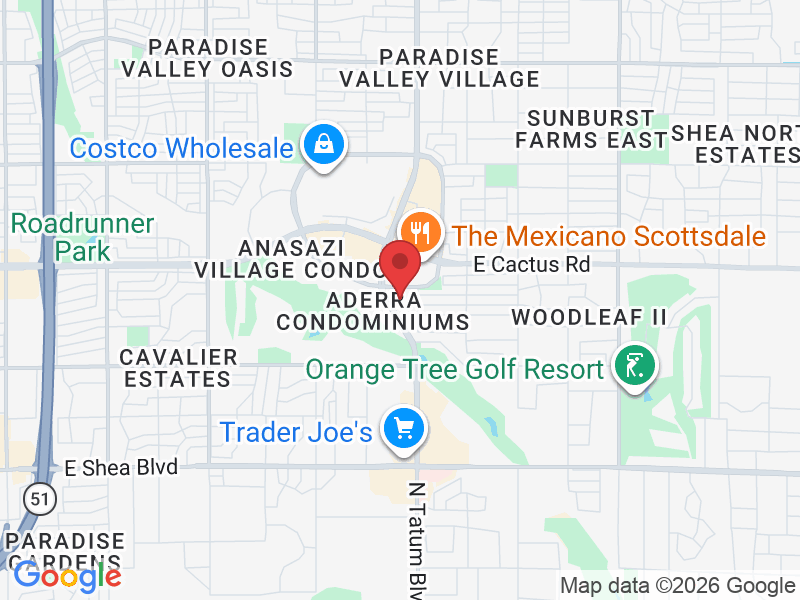

Contact Info

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202