Your Journey Home Starts WITH

TEAM CD OF FAIRWAY HOME MORTGAGE

The home financing process should be as simple and stress-free as possible. Whether you’re buying your first home, upgrading, refinancing, or exploring a reverse mortgage, we’re here to guide you every step of the way. Partnering with Craig Gallegos & Dawn Buxton of Fairway Home Mortgage means you get trusted expertise, competitive loan options, and a dedicated team that treats you like family

How We Work

Our Four-Step Approach

Initial Consultation

We listen first. What are your goals? What’s your timeline? We’ll map it out together.

Loan Options & Roadmap

We review the types of loans that match your needs, walk through the process, and answer your questions.

Application & Processing

We guide you through the paperwork, documentation, and underwriting so you feel informed and confident.

Closing & Beyond

We aim for a smooth closing, then stay available post-closing. Your home financing is a milestone – not the end of our relationship.

WHY CHOOSE TEAM CD?

Decades of proven experience

Dawn brings more than 25 years in the mortgage industry, including underwriting and loan-originating roles, giving you a distinct edge when navigating today’s lending environment.

Craig’s two decades in finance, combined with his hands-on approach, make him uniquely equipped to help you assess options and make informed decisions.

Client-first, transparent service

From the first call to the closing table, you’ll know exactly what’s happening, with no hidden surprises. Our process is built around clarity, integrity, and strong communication — because your dream home deserves nothing less.

Flexible loan expertise

Thanks to our partnership with Fairway, we offer a wide spectrum of loan types — conventional, FHA, VA, reverse mortgages, refinancing and more. Whatever your goal, we’ll help you chart the path forward.

Local insight, national strength

Based in the Phoenix area but supported by Fairway’s national footprint, we combine personal service with big-league resources. That means you get the benefits of a strong platform plus the care of a dedicated team.

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

MORTGAGE PAYMENT CALCULATOR

Estimate your monthly mortgage payment. Use the assumptions section to factor in additional variables like taxes, insurance, and PMI. Contact us today at (602) 858-6293 for a personalized quote!

Disclaimers: The information provided by these calculators is for illustrative purposes only. There is NO WARRANTY, expressed or implied, for the accuracy of this information or it's applicability to your financial situation. The default figures shown are hypothetical and may not be applicable to your individual situation. The calculated results are also intended for illustrative purposes only and accuracy is not guaranteed. There is not tax or financial advice given. Default and calculated tax data are for illustrative purposes only. Be sure to consult a tax or financial professional regarding your specific situation and before relying on the results.

Any hypothetical monthly mortgage payments reflect hypothetical Principal & Interest amounts rounded to the nearest dollar amount and may not include insurance, taxes, or other possible fees. These figures and rates are for educational purposes only and do not reflect an official mortgage loan offer.

Frequently Asked Questions

What type of home loans do you offer?

We offer Conventional, FHA, VA, USDA, Jumbo, refinance options, and reverse mortgages. Our team will help you choose the loan program that best fits your goals and financial situation.

How do I get pre-approved for a home loan?

You can start by completing our secure online application or reaching out to us directly. We’ll review your finances and provide a pre-approval letter to help strengthen your offer when shopping for a home.

What documents do I need to apply?

Typically, you’ll need recent pay stubs, W-2s or tax returns, bank statements, and a valid ID. If you’re self-employed, additional documentation may be required. We’ll walk you through it step-by-step.

Should I find a house first or apply for a mortgage first?

We recommend applying first. A pre-approval tells you exactly what you qualify for and helps you shop with confidence. Once you find the right home, you're already ahead of the process — and sellers are more likely to accept your offer.

How much do I need for a down payment?

Down payments vary by loan program — some programs allow as little as 3% down, and VA loans may require no down payment for eligible borrowers. We'll help you determine what’s right for you.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is an estimate based on self-reported info. Pre-approval verifies your income, credit, and finances — giving you stronger buying power. We recommend getting pre-approved first.

Do you work with first-time homebuyers?

Yes! We love guiding first-time buyers. We’ll help you understand your options, available programs, and the full loan process from start to finish.

What are closing costs and what should I expect?

Closing costs typically range from 2%–5% of the home price and include lender fees, title, appraisal, and other services. We’ll review everything with you so there are no surprises.

How long does the mortgage process take?

Most loans close in about 25–30 days, depending on the loan type and documentation. We keep communication clear to help you close on time.

Can I refinance my current mortgage with you?

Yes. Whether you want a better rate, a lower payment, or to access equity, we’ll help you explore refinancing options and see if it makes financial sense.

Still have questions?

We’re here to help!

Contact Info

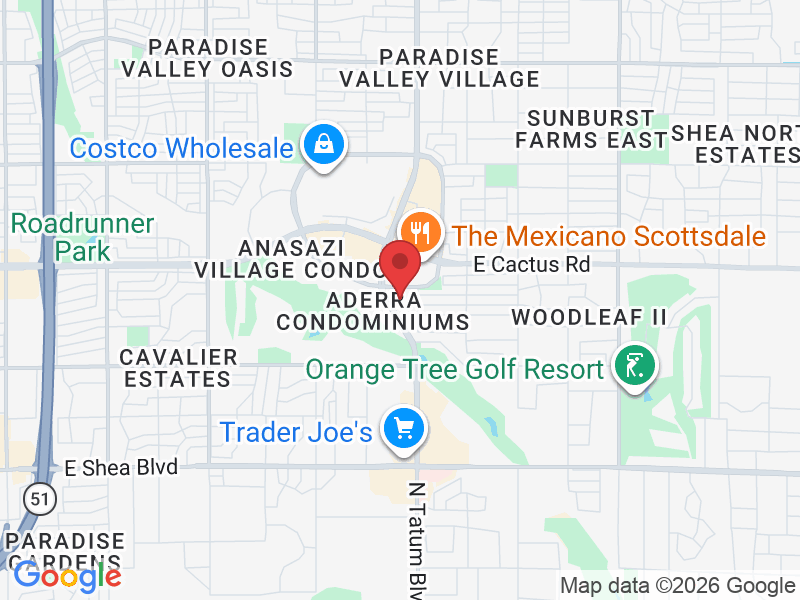

Location

11811 N Tatum Blvd Suite 2700

Phoenix, Arizona 85028

We’re here to help you with all your healthcare needs.

Reach out to us anytime—our friendly team is ready to assist you with appointments, inquiries, and guidance.

Phone

Loan Officers

Craig Gallegos NMLS# 447602

Dawn Buxton NMLS# 308905

Corporate Address:

11811 N Tatum Blvd, Suite 2700

Phoenix, Arizona 85028

Copyright © 2026 Fairway Independent Mortgage Corporation doing business as Fairway Home Mortgage. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. Arizona Mortgage Banker License No. 0904162. Dawn Buxton NMLS 308905 | Craig Gallegos NMLS 447602 Complaints may be directed to: (877) 699-0353 or Email us: [email protected]. Licensed by the Department of Business Oversight under the California Finance Lenders Law. Loans made or arranged pursuant to a California Finance Lenders Law License. Licensed Nevada Mortgage Lender NMLS #2289 Craig Steven Gallegos MLO# 447602 Dawn Marie Buxton MLO#308905. Office Phone 480-626-2202